Why is Japan more developed than India?

Let's destroy some myths first

- Myth 1 - Japanese are more developed because they work hard -

- Yes they do work hard. But does that mean we Indians don’t work hard? There is not a single country on the planet where people don’t work hard.

- If working hard was the reason, Mexico would be wealthier than Germany. (India is not a part of OECD so it is not in the list)

- Myth 2 - Japanese save money

- Yes, they do save money. But first you need to create money before you can save it. I’ll come to that in a min.

- Myth 3 - Japan got rich because of exports

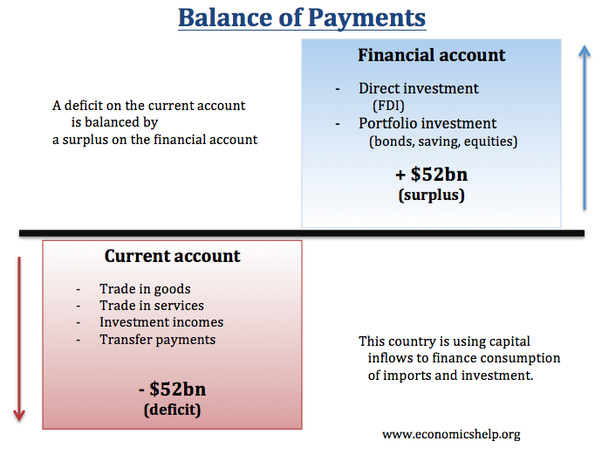

- Trade surplus is capital deficit. What it means is that if Japan is exporting more than it imports, it must be investing more in foreign countries than foreign countries are investing in Japan. That indeed is true and Japan invests a lot in foreign countries.

- There is no direct relation between trade surplus and development of a country.

- Russia has a 41 Billion dollar trade surplus, Iran has a 21 Billion dollar trade surplus and Thailand has 50 Billion trade surplus.

- US has 500 Billion dollars trade deficit, UK has 91 Billion trade deficit.

- Who is more developed? US/UK or Russia/Iran/Thailand??

Now coming to the question, why is Japan more developed than India?

Lets imagine a situation. You are a pen maker. I want to buy lot of pens for my office. I use my credit card to buy 20000 rupees worth of pens from you. So now I have a debt of 20000. That 20000 is now your earning.

What will you do with that 20000? Lets say, 5000 goes towards loan payments, 5000 goes towards investment in your pen factory and 5000 goes towards rent of your house. The rest goes in savings.

So what I am saying here is - my debt is now your income.

And somebody else’s debt is my income.

That’s how modern economy works. More than 95% of all money in existence is actually credit.

So how did Japan get rich?

By credit expansion !

As I have just explained. My borrowing is your earning. The more I am able to borrow, the more you will earn. The more your earn, the more you will invest and the economy will grow. So if (almost) everyone in the economy is able to borrow a lot of money, the incomes will grow, the investment will grow, the output will grow, the employment will increase and the nation will get more developed.

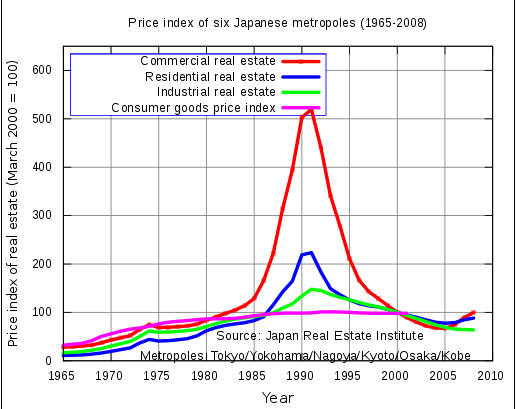

That’s what they did in Japan in 1970s and 1980s. They had a massive credit expansion. Banks were giving huge amount of loans . That increased incomes, investments, productivity and the quality of life.

Lets see how this credit expansion worked -

As getting a loan was easy, a lot of companies were able to expand. As companies expanded, the demand for office space grew.

The property developers, seeing the growing demand of office space, borrowed a lot of money and started developing massive projects.

Japan was expected to takeover US as the biggest economy in the world. Here is what was happening during Japan’s miracle growth -

- Interest rates were so low that loans were practically free and banks and businesses were flush with cash. Japanese businessmen invested and borrowed as if there was no tomorrow, pushing up prices of stock and real estate even further. The influential Japanese philosopher Akira Asada dubbed it “infantile capitalism."

- In the bubble economy businessmen boasted of spending $30,000 in one night out and $300,000 in one week of partying. People flew from Tokyo to Sapporo just to enjoy a bowl of noodles and waved ¥10,000 banknotes to get taxis when taxis were scarce. Hard working Japanese.

- Easy money inflated the markets -

- Everyone was borrowing and investing in hopes of high returns.

- Americans were worried -

- Cheap credit allowed Japanese companies to invest and expand. Companies in US got no such privilege.

- Banks, insurance companies and other financial institutions made many foolish and highly speculative investments.

And then the bubble economy collapsed -

- Japan had 2 decades of no economic growth -

- The massive wasted investments are still hurting Japan-

- In Japan, you need to invest $51 to generate $1 in new GDP. In India, you need to invest just $4 to generate $1 in new GDP. Look at the Capital output ratio. Japan is the most terrible place to invest.

- China and India are clearly in much better shape than Japan -

- Looks like its we Indians who are working hard.